GTA MARKET REPORT

MAY 2025

April brought a dynamic mix of trends across the GTA real estate market, with notable shifts in both pricing and activity levels. While areas like Aurora, Thornhill, and Newmarket saw strong gains in sales and price growth, others such as King and Kleinburg experienced fewer transactions but significant price surges—particularly in the luxury segment. Toronto remained steady, with balanced inventory growth and rising prices, while Richmond Hill and West Woodbridge saw healthy appreciation and active market movement. Meanwhile, East Woodbridge and Maple reflected more cautious buyer behavior with longer days on market. Across the board, rising inventory suggests increasing seller confidence, while extended selling times in some areas may indicate that buyers are becoming more selective this spring.

WOODBRIDGE

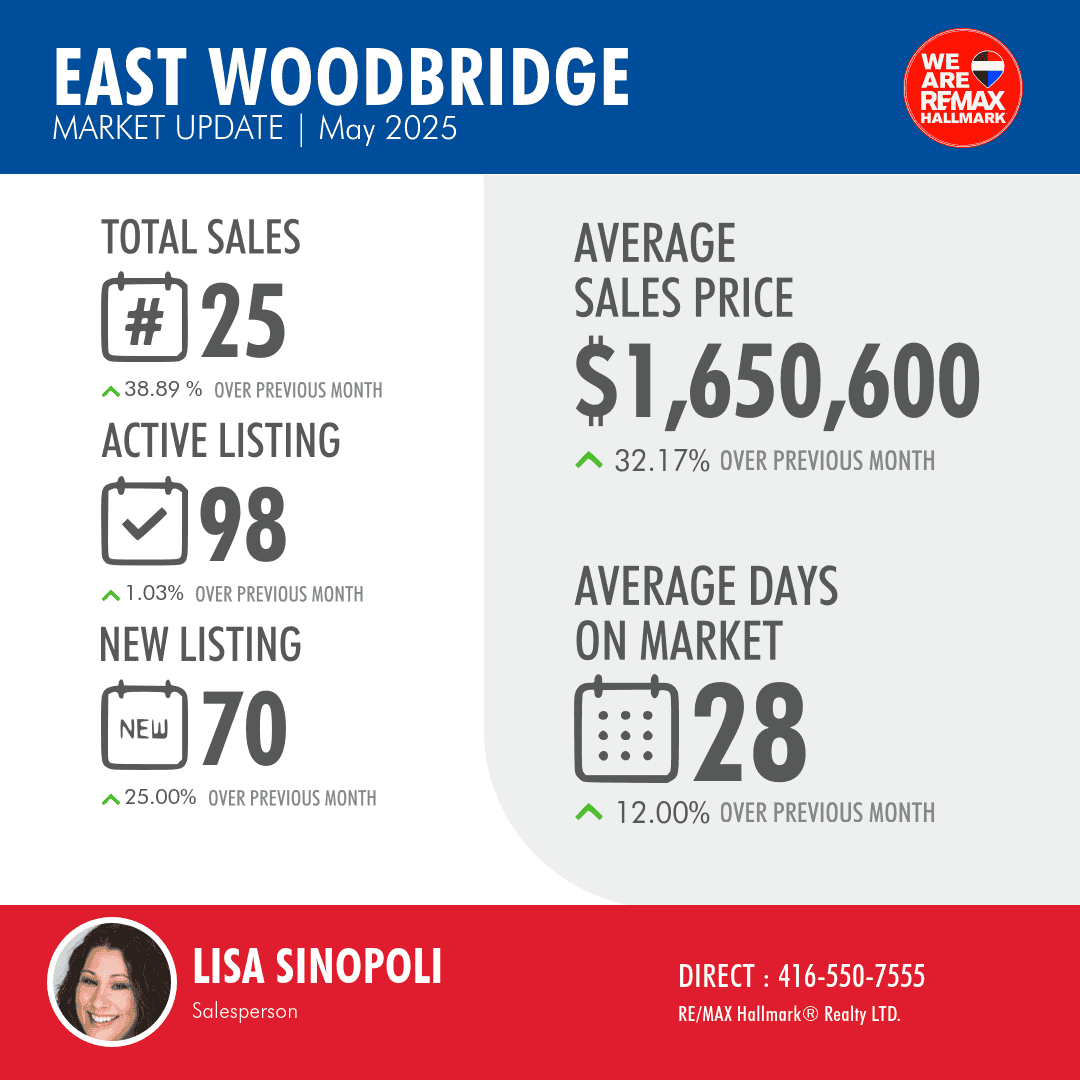

In May 2025, East Woodbridge showed strong market momentum, with a 38.89% rise in total sales and a sharp 32.17% increase in average sale price to $1,650,600. More listings hit the market, and homes sold in an average of 28 days. This indicates a seller’s market—ideal for those looking to list, while buyers face rising prices and growing competition. Investors can expect solid appreciation and stable demand.

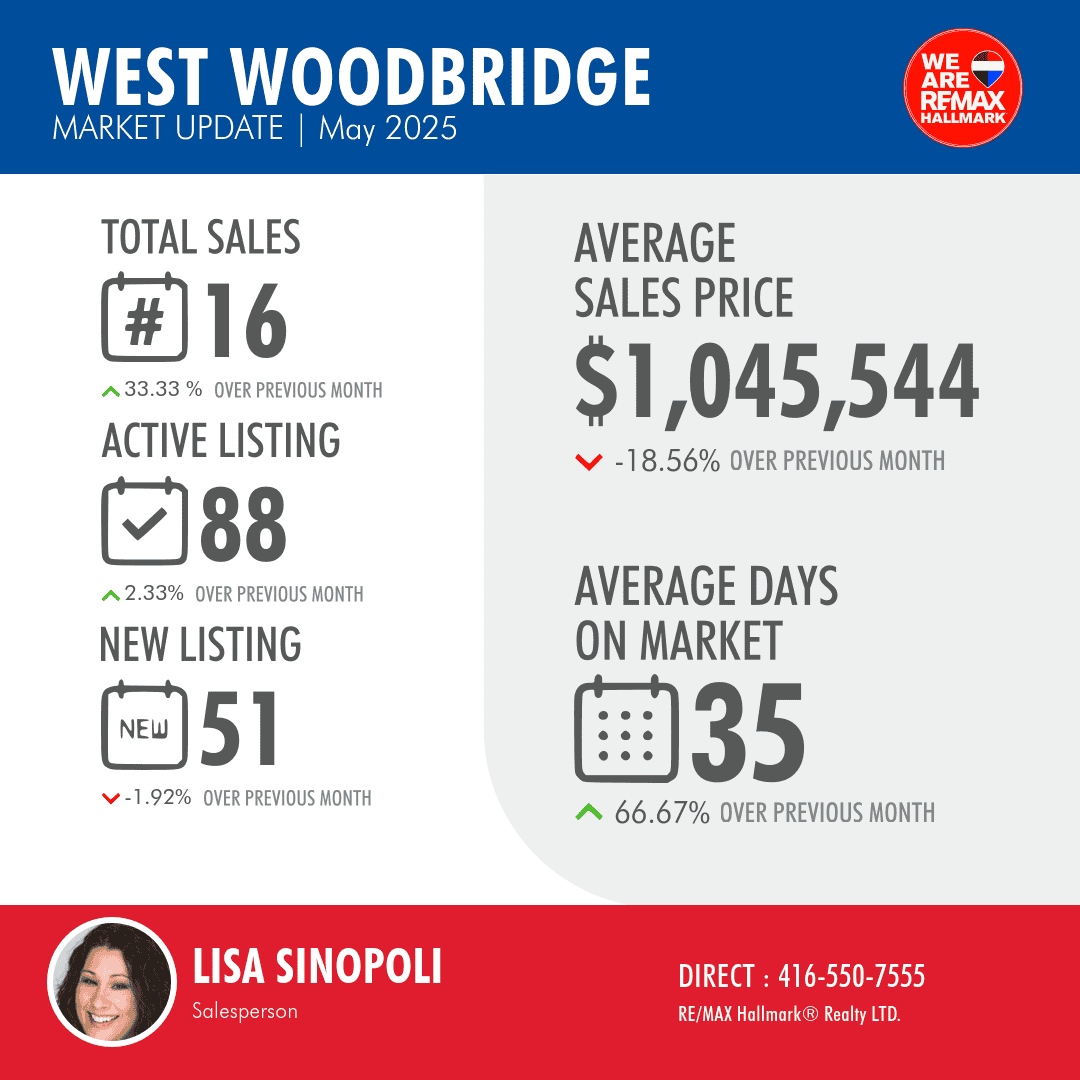

In contrast, West Woodbridge experienced a cooling trend. Despite a 33.33% rise in sales, the average sale price dropped 18.56% to $1,045,544, and homes stayed on the market longer—an average of 35 days. With fewer new listings and softer prices, this area favors buyers and investors seeking value opportunities. Sellers will need to price competitively to stand out.

Overall, East Woodbridge benefits sellers and long-term investors, while West Woodbridge presents more affordability and potential for buyer leverage.

MAPLE

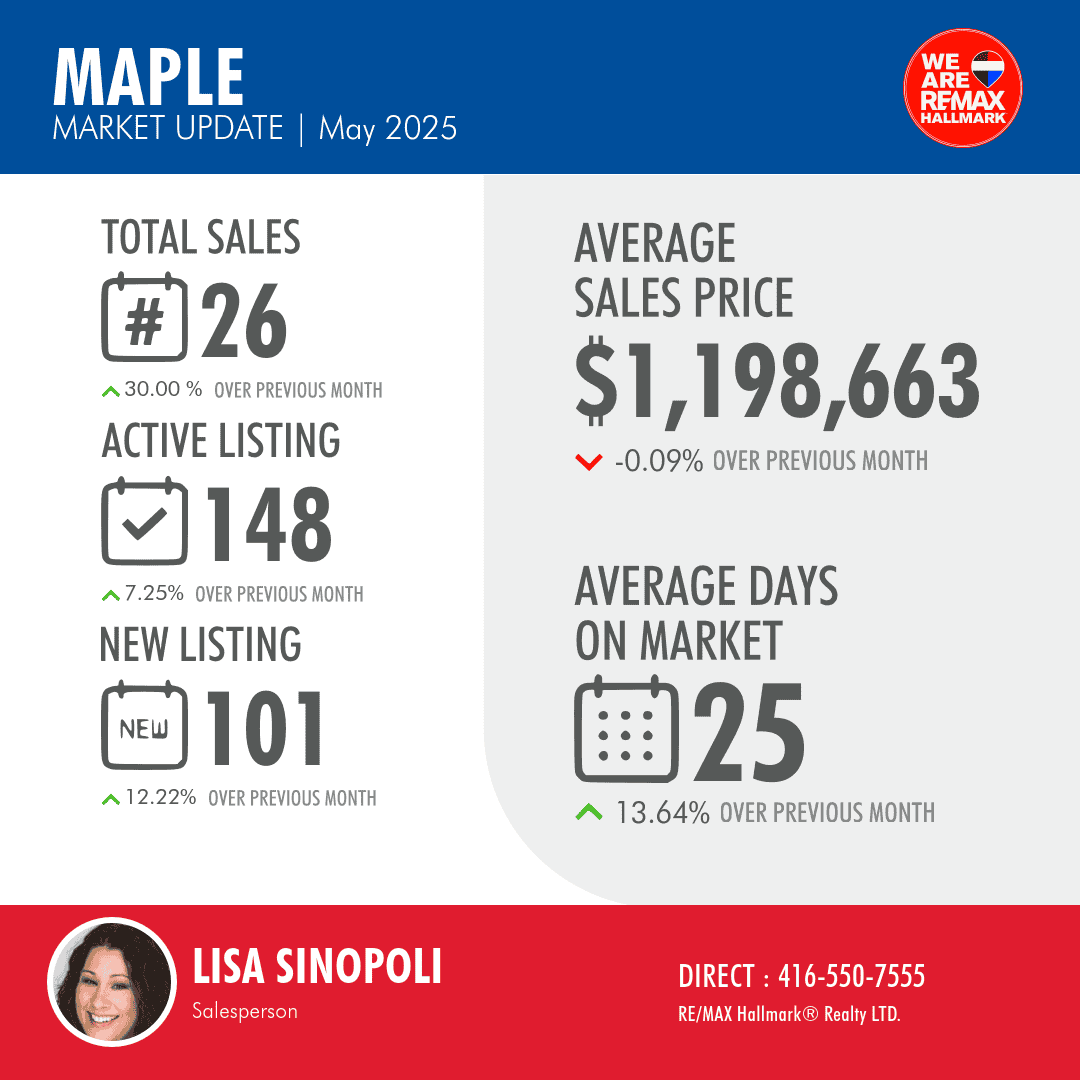

Maple’s real estate market saw steady activity in May 2025. Total sales rose 30% to 26 transactions, while active listings increased 7.25% to 148, and new listings were up 12.22%, indicating growing inventory and seller confidence. The average sale price held steady at $1,198,663, with only a minimal decline of 0.09%. Homes took slightly longer to sell, with average days on market increasing to 25 days (+13.64%).

For sellers, conditions are encouraging as buyer demand is strong and inventory is growing without significantly impacting prices. For investors, Maple offers a balanced market with stable prices and room for moderate growth.

RICHMOND HILL

In May 2025, Richmond Hill experienced a mixed market. Total sales declined by 20.36% to 133 homes, despite an 8.10% rise in average sales price to $1,458,976. Inventory grew notably, with 1,186 active listings (up 8.71%) and 753 new listings (up 19.15%), signaling strong seller interest. However, homes are taking longer to sell, with the average days on market rising to 31 days (+19.23%). Sellers may still benefit from rising values but should expect stiffer competition and potentially slower transactions.

TORONTO

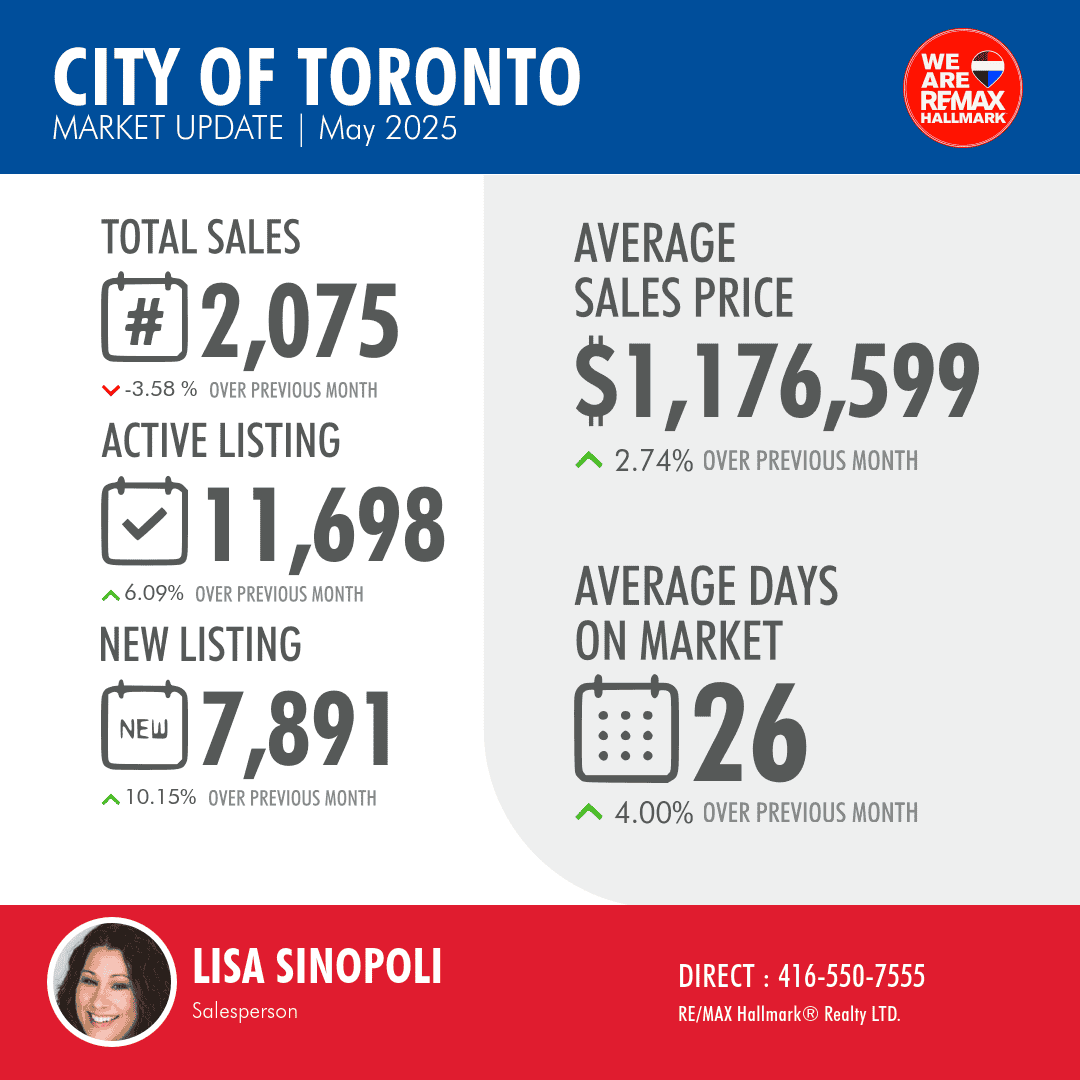

In May 2025, the Toronto real estate market remained active with 2,075 total sales, down slightly by 3.58% from April. Despite the dip in sales, both inventory and prices increased: active listings rose to 11,698 (+6.09%) and new listings climbed to 7,891 (+10.15%). The average sale price increased to $1,176,599, a modest 2.74% gain, while average days on market also ticked up to 26 days (+4%).

For buyers, the increase in listings offers more selection, though moderate price growth suggests continued competition. Sellers can feel confident in stable demand and rising values but may need to adjust to slightly longer selling times.

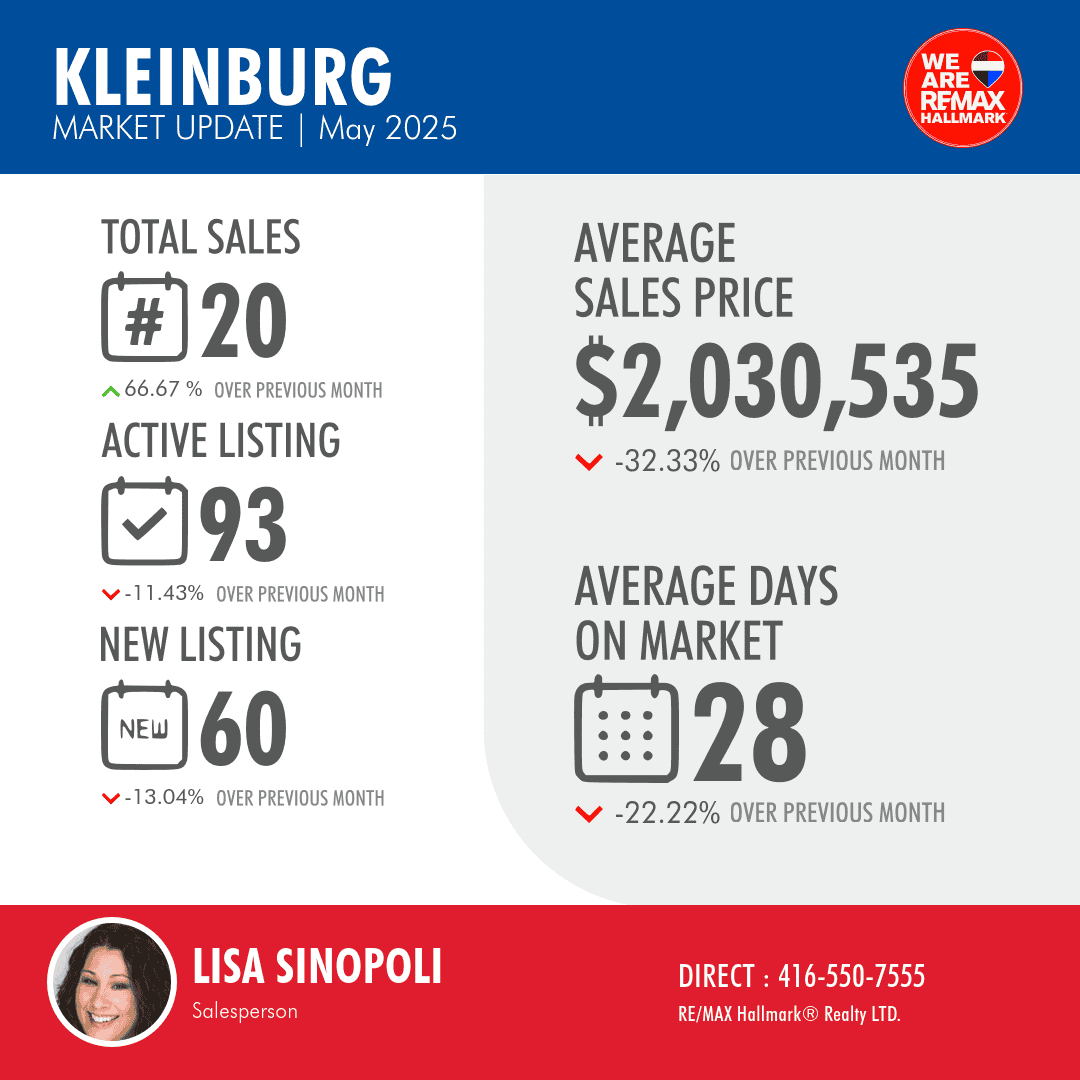

KLEINBURG

Kleinburg’s market saw a notable shift in May 2025. Total sales jumped 66.67% to 20 homes, indicating renewed buyer activity. However, this came alongside a sharp drop in average sale price to $2,030,535, down 32.33% from the previous month. Inventory also tightened, with active listings down 11.43% to 93 and new listings down 13.04% to 60. Interestingly, average days on market dropped by 22.22%, suggesting homes are selling faster despite the price decline.

For buyers, Kleinburg now presents a strong value opportunity, especially at luxury price points. Sellers should be mindful of shifting pricing expectations and may need to adjust to meet market demand.

THORNHILL

Thornhill’s real estate activity slowed significantly in May 2025, with total sales dropping 62.5% to just 3 homes sold, despite a 13.03% rise in average sale price to $1,375,000. Inventory rose, with active listings up 14.89% to 54 and new listings climbing 55% to 31. Meanwhile, homes sold faster, with average days on market dropping to 26 days, a 27.78% improvement.

For buyers, the increased inventory and faster market pace offer better opportunities, although limited sales activity may indicate uncertainty. Sellers should remain realistic given low demand. Investors should approach with caution, as the low transaction volume suggests a cooling market.

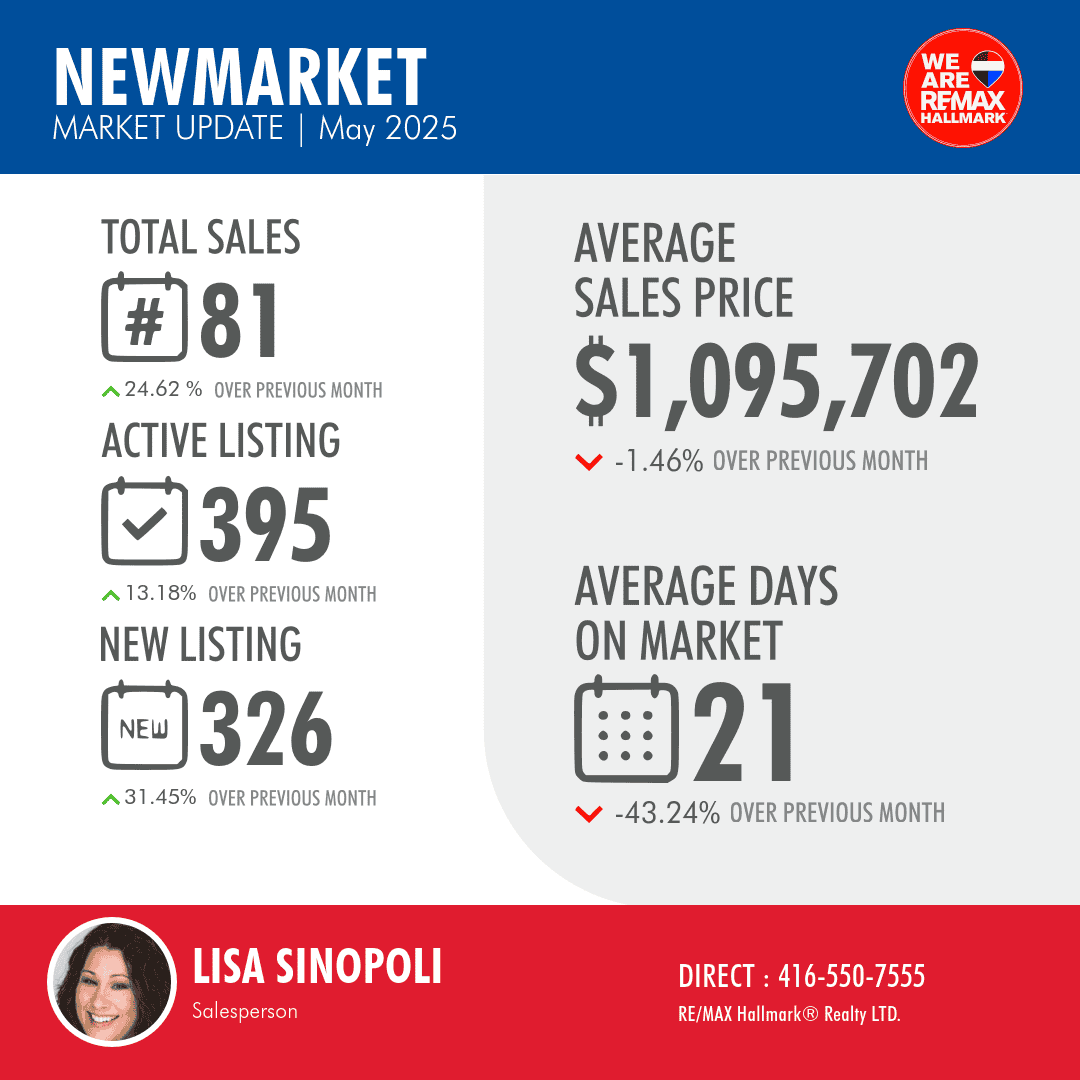

NEWMARKET

Newmarket’s housing market showed strong activity in May 2025, with total sales rising 24.62% to 81 homes. Inventory also expanded, with 395 active listings (+13.18%) and 326 new listings (+31.45%). Despite this surge in activity, the average sale price dipped slightly by 1.46% to $1,095,702. However, homes sold faster, with average days on market falling to just 21 days, a 43.24% decrease.

For buyers, Newmarket presents a fast-moving market with ample new inventory, though prices remain relatively stable. Sellers benefit from quick turnover and strong demand, but should be mindful of pricing competitively.

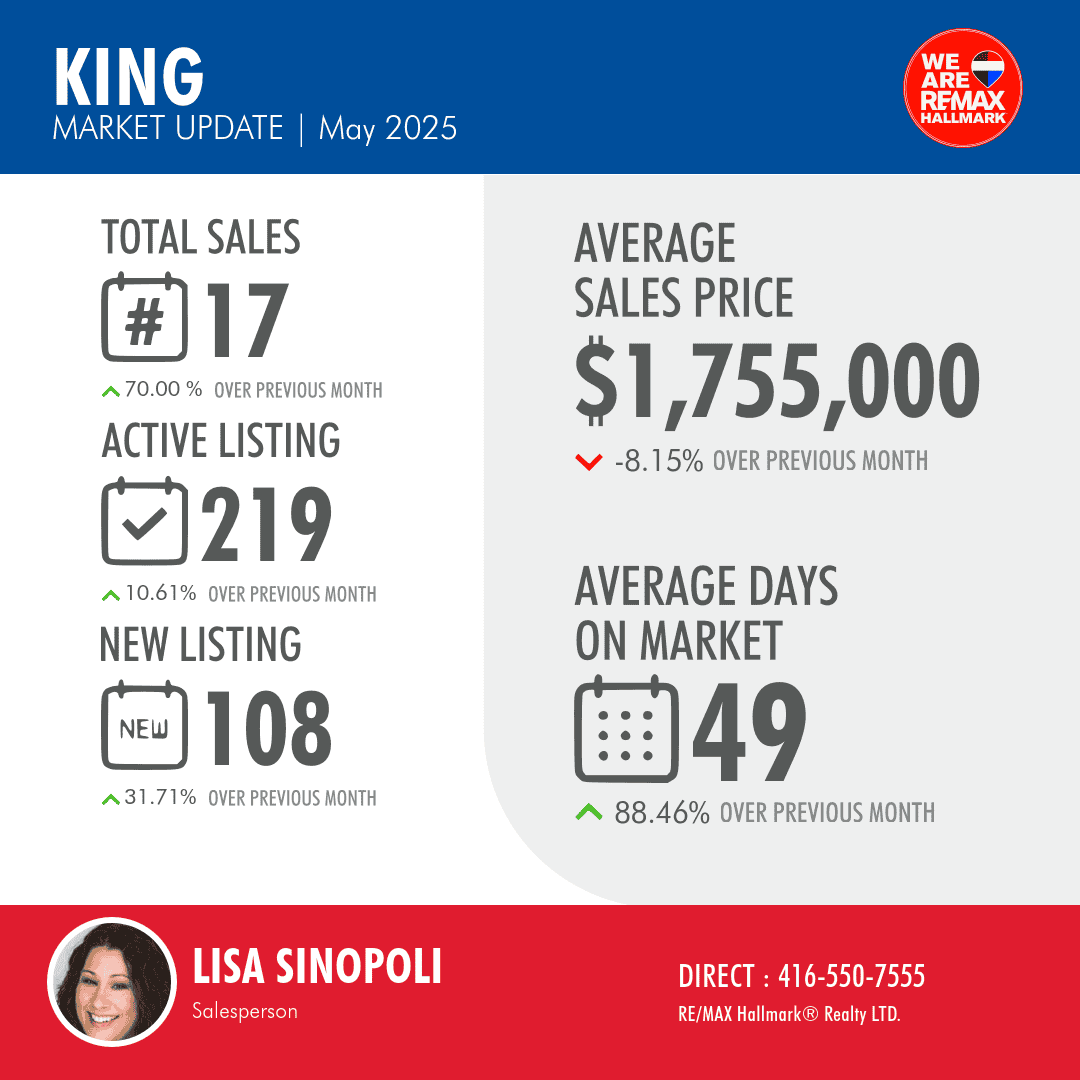

KING

In May 2025, King saw a significant 70% increase in total sales, reaching 17 transactions, while inventory rose, and 108 new listings (+31.71%). Despite the uptick in activity, the average sales price dropped by 8.15% to $1,755,000. Homes are also taking longer to sell, with average days on market jumping to 49 days, an 88.46% increase.

For buyers, the market presents more selection and negotiating power as prices ease and properties remain on the market longer. Sellers should price strategically and prepare for extended timelines. Investors should account for slower turnover in this higher-end segment.

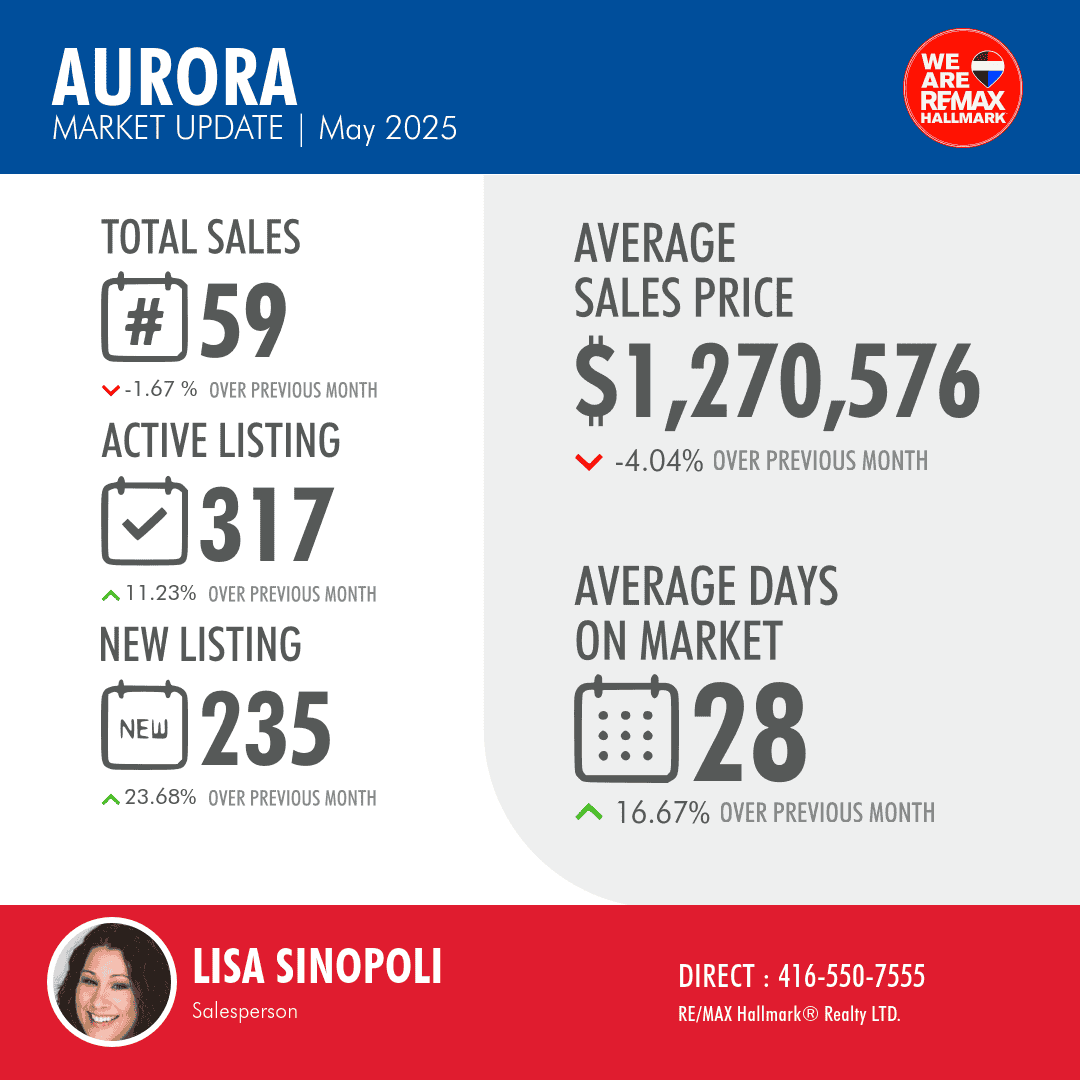

AURORA

Aurora’s housing market in May 2025 was relatively steady with 59 total sales, down just 1.67% from April. Inventory increased as active listings rose 11.23% to 317 and new listings surged 23.68% to 235. Despite more supply, the average sale price declined 4.04% to $1,270,576, and days on market rose to 28 days, up 16.67%. For buyers, Aurora offers more selection and potential for better pricing as supply increases. Sellers may need to be more flexible on pricing and expectations due to growing competition. Investors can view the market as balanced, with modest pricing shifts and solid sales activity.